Staff Writer

Harare, Total expenditure for Pension Fund Administrators amounted to $96 billion in the quarter to March 2024, against an income of $70,7 billion, resulting in a loss of $25,5 bln.

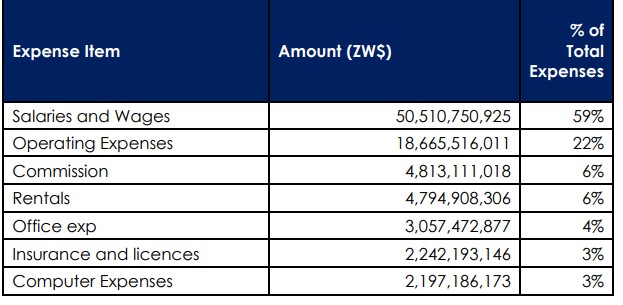

According to the Ipec Pensions Report for the quarter under review total expenditure was mainly comprised of salaries and wages, operating expenses, commissions and rentals.

Salaries and wages at $50,51 billion accounted for 59% on the total expenses followed by operating expenses at $18,66 billion.

Major Cost Drivers for Fund Administrators

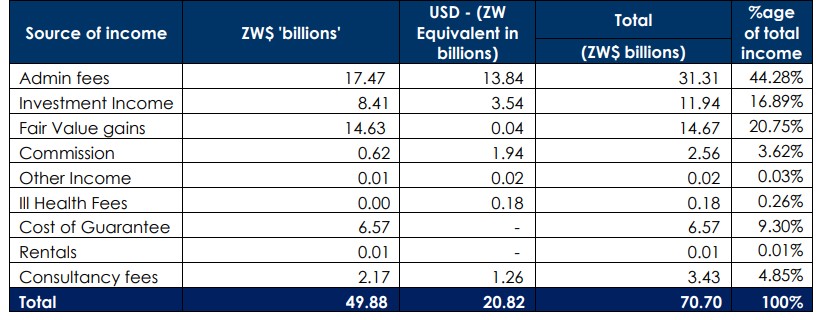

According to the report, total income earned by fund administrators from fund administration business for the period at $70,7 billion compared to $6 billion in Q1, 2023.

Of that amount, forex income was US$1,33 million, thus constituting 29% of total income earned as 10 out of the 13 administrators recorded USD business.

Income from fund administration fees earned by administrators for services rendered was $31.31 billion, constituting 44% of the total income.

Of the administration fees earned, 79% was transacted in foreign currency. The table below shows the administration fees as a component of the total income for each administrator and the extent to which such fees are in forex.

: Sources of Income for Administrators

Experts believe the Administrators income is consistently under threat as more Pension Funds are earmarked for dissolution.

Ipec has since halted dissolutions of about 372 funds that were earmarked for dissolution to allow conclusion of the pre-2009 compensation.

According to the Pensions report, there were 966 registered occupational pension funds as of March 31, 2024, compared to 978 funds in 2023 during the same period, with the decline mainly attributed to fifteen dissolutions that were finalised during the year.

But during the period under review, there were eight transfers and six new funds that were registered.

“Of the 966 funds, 481 were active, accounting for 49.79 percent of the industry’s funds.

“The remaining 485 funds were inactive as they were either paid up or earmarked for dissolution,” reads the report.

Ipec noted that of the total funds, 40 pension funds were defined as benefit schemes, while the remainder were defined as contribution schemes.

Only 14 of the 966 registered funds conduct in-house fund administration, and the remainder, which are insured (800) and self-administered funds (152), outsource the services from fund administrators.