Staff Writer

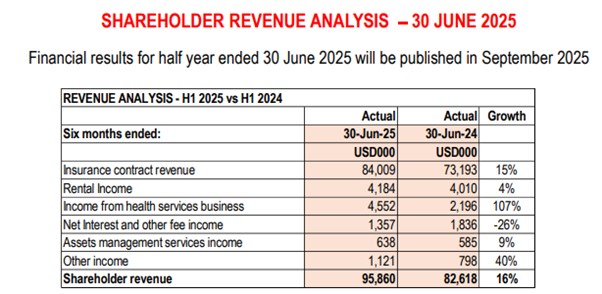

First Mutual Holdings (FMHL) Insurance Contract Revenue (ICR) for the half-year period to June 30, 2024, grew by 15 percent year-on-year to US$84,009 mln compared to US$73,193 mln for the same period in 2023, primarily driven by increased customer uptake.

Chief executive Doug Hoto told shareholders at the group’s annual general meeting (AGM) that the pure USD ICR contribution remained steady at 82 percent of total revenue, consistent with the prior year.

“Overall, USD-denominated revenue accounted for 80 percent of the total revenue for the period ended 30 June 2025, up from 78 percent in 2024,” he said.

Hoto said the group continued to operate profitably during the half-year period and also managed to complete significant projects both in the region and locally.

Hoto said on regional initiatives, First Mutual Reinsurance has consolidated its presence in Botswana and is therefore venturing into East Africa, having completed business registration processes and awaiting approval of the operating license.

In addition, First Mutual Health was granted an operating license in Botswana on 5 May 2025, and business development operations are expected to be launched in H2 2025.

“Diamond Seguros expanded into health insurance in Mozambique, and the group recapitalised UGI to enhance operations,” said Hoto.

He said local initiatives include First Mutual Life’s launch of the land-backed product (Imba Yangu / Indlu Yami Savings Plan), which provides access to a residential stand valued from a minimum of USD 15K with an option for a tax-free cash benefit equivalent to the sum assured on death or saved amount on maturity.

During the period under review, First Mutual Wealth completed Midlands Park (Zvishavane) Phase 1, encompassing 20 blocks of residential flats and cluster houses, delivering 116 family housing units due to be officially opened in Q3 2025.

Hoto said First Mutual Health Services opened a full-fledged integrated health facility in Beitbridge and expanded service offerings in Masvingo and Mutare by adding dental and optometry units.

He said the first gold ETF product, the First Mutual Wealth gold exchange-traded fund, was approved.

The fund tracks gold assets and gold mining shares that are listed on the JSE, and the fund is expected to be listed on the VFEX during H2 2025.